From Science to Scale: The Growing Impact of Quantonation’s Investments

Paris, France and Boston, USA – 4th March 2025

Since its inception in 2018, Quantonation has contributed to the emergence of the global quantum technology ecosystem. In December 2023, we made public in the paper « Investing in the Quantum Future : State of Play and Way Forward for Quantum Venture Capital » portfolio statistics for three dimensions: funding and investment, job creation and diversity, scientific and technological contributions.

Today we are releasing updated statistics (as for end of ’24) from the Quantonation portfolio that demonstrate remarkable growth across all dimensions, reinforcing the fund’s position as a key player in quantum venture capital. These statistics include for the first time data from both Quantonation I and Quantonation II. Both funds are similar in scope, spanning computing, networks, sensors, hardware, software, and enabling quantum-adjacent technologies, and stage (early).

Quantonation I has closed its investment period and shows already a top quartile performance for a VC fund of this vintage. Quantonation II has reached €110M raised at the end of 2024, on a good way towards more than €150M at final closing. Quantonation I has 25 companies under management including leaders such as Pasqal, Qubit Pharmaceuticals, Nord Quantique, Multiverse and others. Quantonation II has already invested in 7 startups from Australia to France and USA including Diraq, QbloX and Tau Systems.

Each investment of €1M by Quantonation is estimated to generate €4M in additional investments, secure €1M in grants, contribute to research with around 5 scientific publications, and foster innovation through 5 patents. It is also expected to create an average of 1.3 jobs, with 30% of these positions held by women.

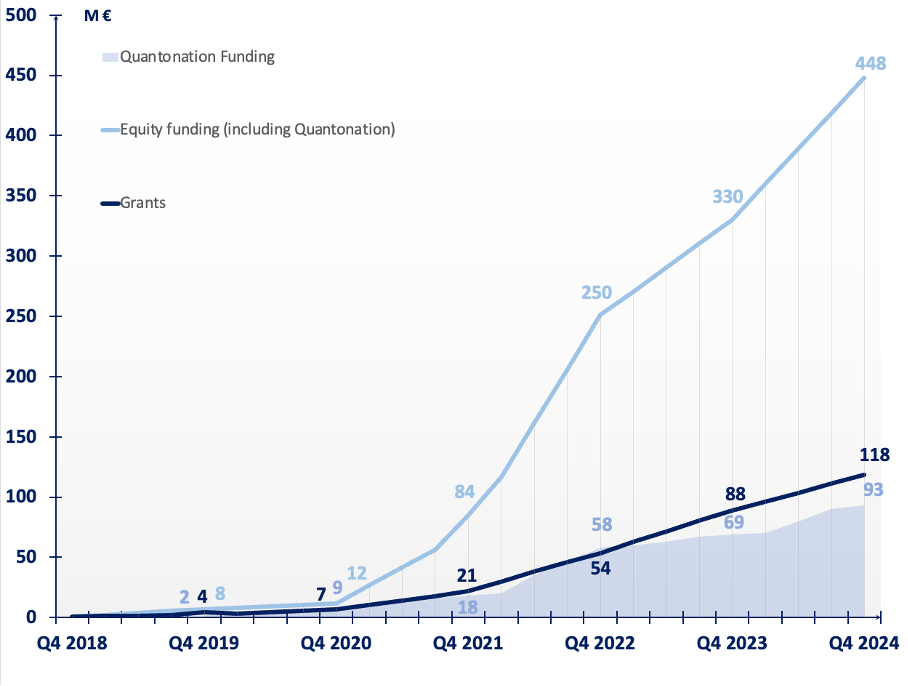

Funding and Investment Growth

The updated data highlights a strong trajectory in total funding. Quantonation-backed startups have collectively raised significant equity funding, reaching €448m by Q4 2024, with a strong multiple of approximately x5 with respect to Quantonation’s investment. Public grants continue to be a vital component, surpassing €118M. This sustained increase in investment reflects growing confidence from co-investors and government agencies, reinforcing the importance of early-stage quantum investment.

Figure 1 – Equity investment (including Quantonation) and grants (public funding) for the portfolio of 32 active investments in funds Quantonation I and II end of 2024.

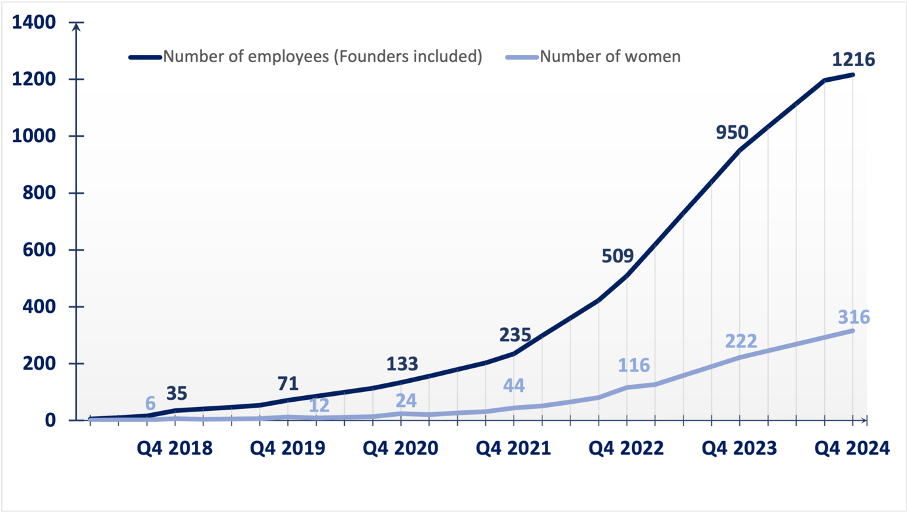

Job Creation and Diversity

Employment within the Quantonation portfolio has grown exponentially, from just 35 employees in Q4 2018 for our first investment to over 1,200 by Q4 2024. Notably, the representation of women in the workforce has improved, reaching 316 employees, though gender diversity remains an area for continued effort. Quantonation’s portfolio has been characterized from the start by a diversity of nationalities as well.

Figure 2 –Total portfolio jobs created, share of women.

The rise in employment underscores the expanding commercialization of quantum technologies, transitioning from research-driven ventures to scalable enterprises, especially for Quantonation I portfolio.

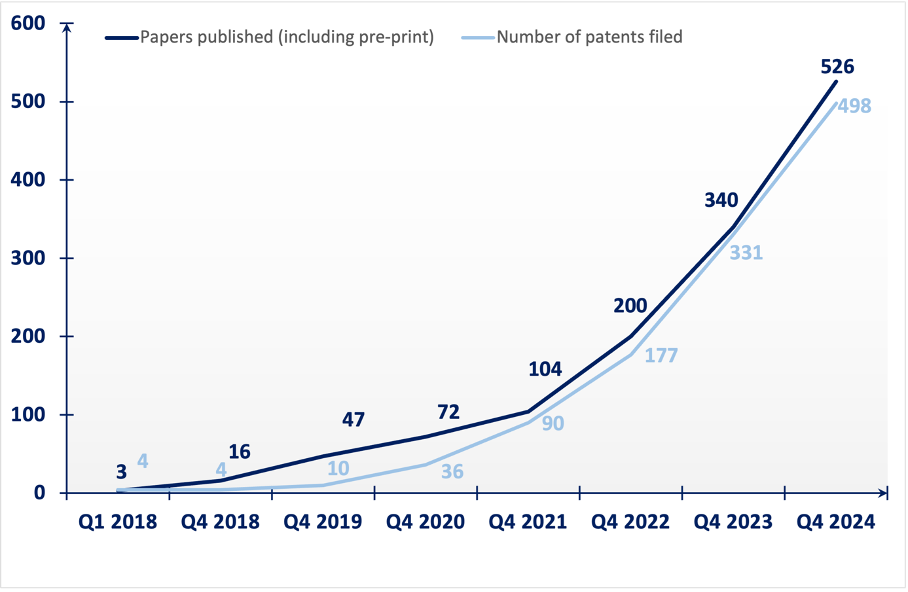

Scientific and Technological Contributions

With an exciting news flow in the field of quantum technologies, we remain firm in our belief that scientific publications are one of the most important indicators in the quantum startup ecosystem. Not only do publications help attract top talent and facilitate valuable connections within key academic ecosystems, but they also serve as a crucial public measure of scientific credibility in a commercial world often prone to hype. The importance of maintaining this balance between scientific rigor and market excitement cannot be overstated.

Figure 3 – Papers (pre-prints are included until peer-reviewed publication) and patents filed.

The number of peer-reviewed papers and patents continues to climb at an impressive rate. By Q4 2024, over 526 papers have been published by our portfolio, with nearly 500 patents filed. This surge in intellectual property generation highlights the scientific maturity of quantum startups and their increasing role in driving technological innovation. It also aligns with Quantonation’s strategic focus on fostering fundamental research alongside commercialization.

Notable publications from our portfolio put forth the high-caliber scientific work driving the quantum sector forward. For instance, Diraq’s publications in Nature, QphoX’s publication in Nature Physics, ORCA’s work featured in Physical Review Letters, Pasqal’s in Physical Review Research, Qubit Pharmaceuticals’ publication in Nature Communications Chemistry, or Quandela’s publication in Nature Photonics are a few examples of the world-class research we see across our portfolio highlighting the depth of scientific talent and innovation we support.